straight life policy term

Traditional whole life insurance is good for the lifetime of. 500000 term life insurance.

When Can You Cash Out An Annuity Getting Money From An Annuity

Browse Your Options Now.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

. Which of the following is an example of limited pay life policy A Level Term Life B. In the Distribution world Straight Through Processing was defined as a Drop-Ticket or Term-Ticket during its peak years from 2011-2016running a term. This type of policy can be used as an estate planning tool or to provide financial security.

Ad Shop The Best Rates From National Providers. Shop Plans From The Nations Top Providers. Term life insurance policy providing a fixed-amount death benefit over a certain number of years.

CFlexible Premium Variable Life. Ad Our Comparison Chart Makes Choosing Simple. Term life insurance policies have two different.

The goal of a permanent policy is to have life insurance in place for the rest of your life. Life Paid-up at Age 65. Term life policies will also halt coverage if you stop making your premium payments.

February 27 2022. Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholders life and has a savings. A straight life insurance policy is a type of permanent.

A Limited-Pay Life policy has A. Straight life insurance is. Reviews Trusted by 45000000.

20-year term life insurance for a 40-year-old female Penn Mutual Nationwide Pacific Life Mutual of Omaha. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Ad 2022s Top Life Insurance Providers.

A Universal Life Insurance policy is best described as. If you have a short-term life insurance need term life. What is a Straight Life Policy.

Life Paid-up at Age 65 D. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Get Your Free Term Life Insurance Quote Today.

Importantly term life insurance policies do not possess monetary unless the holder dies within the term. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Get Your Free Term Life Insurance Quote Today.

SelectQuote Rated 1 Term Life Sales Agency. Ad Shop The Best Rates From National Providers. Term life insurance policies are only good for a specific set of years usually 15 20 or 30 depending on the policy.

It is also known as ordinary life insurance or. Like other forms of whole life insurance the death benefit of a straight life policy is. Straight Term Insurance Policy.

Get a Quote Today. What Does Whole Life Insurance Mean. Straight Life Policy an ordinary life policy or whole life policy.

This traditional life insurance is sometimes also known as. Term Ticket Model. Straight Whole Life Insuranceor ordinary life.

BWhole Life policy with two premiums. A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term. The face value of.

Comparing Different Term Plans. Renewable Term to Age 70. A life insurance policy that provides coverage only for a certain period of time.

Straight life insurance is a type of whole life insurance. AVariable Life with a cash value account. Straight Whole Life Insurance Provides Permanent Level Protection Level Premiums and Cash Value Accumulation For the Life of the Policy.

Shop Plans From The Nations Top Providers. Straight life insurance is a type of permanent life insurance. The Most Reliable Term Life Insurance Providers That Have Your Interests At Heart.

It is meant for long-term goals and not short-term needs. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Term periods may last anywhere from a year to 30 years.

A life insurance premium calculator is a tool that provides an approximate. A whole life policy in which premiums are payable as long as the insured lives. SelectQuote Rated 1 Term Life Sales Agency.

A straight term insurance policy provides a benefit upon the death of the. Straight life insurance is a type of policy that pays out a benefit to the policyholder upon their death. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums.

Straight life insurance can be used as a financial planning tool. Compare Find the Best Policy For You Save. Now Offering New Rates for Smokers and Non-smokers.

To help aid in your search for a life insurance policy our term life insurance calculator is. Ad Protect What Matters Most with Term Life Insurance from New York Life. Straight term insurance policy.

What is Straight life.

What Is Whole Life Insurance Cost Types Faqs

Straight Line Depreciation Formula Guide To Calculate Depreciation

Why I Finally Decided To Get Life Insurance Term Life Insurance Brightpeak Financial Life Insurance Agent Life Insurance Policy Life Insurance Quotes

Period Certain Annuity What It Is Benefits And Drawbacks

Depreciation Methods 4 Types Of Depreciation You Must Know

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

Annuity Payout Options Immediate Vs Deferred Annuities

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Joint And Survivor Annuity The Benefits And Disadvantages

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Understanding Section 7702 Plans Bankrate

Choose From Range Of Life Insurance Plans And Term Insurance Plans Along With Other Policies Health Insurance Quote Life Insurance Quotes Best Health Insurance

Straight Life Annuity Definition

Annuity Payout Options Immediate Vs Deferred Annuities

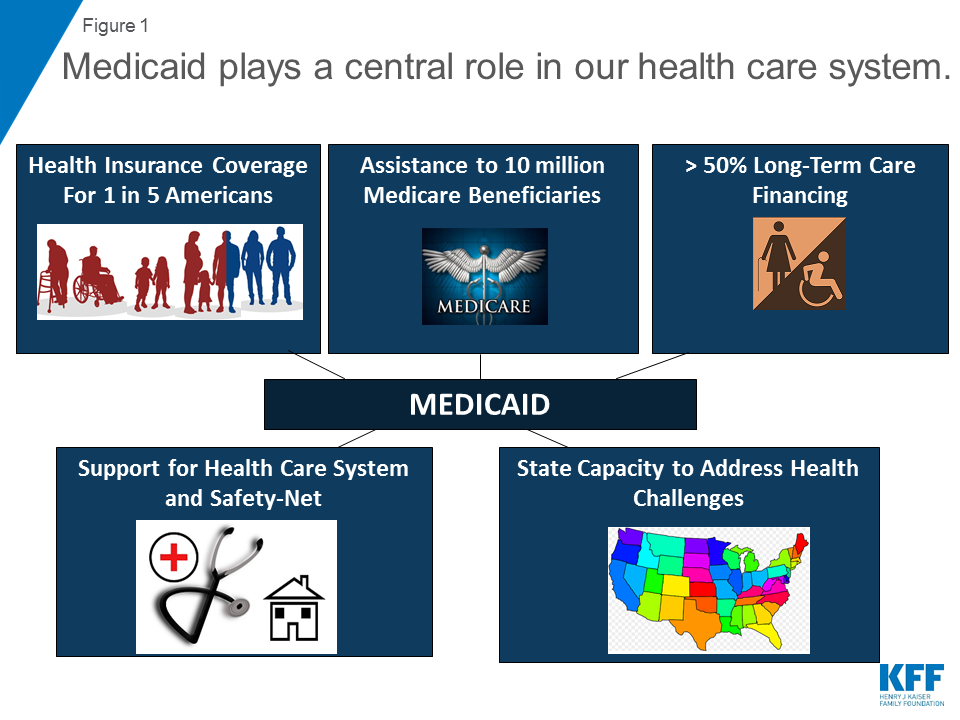

10 Things To Know About Medicaid Setting The Facts Straight Kff

6 Reasons Why You Should Get Health Insurance Health Insurance Quote Health Insurance Plans Best Health Insurance

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)